How to request a VAT or tax refund (Hardware & Software) - Check Basecamp for updates¶

We can create the invoice w/wo VAT for orders on Shopify & Amazon.

VAT is applied to several regions, and the configuration is established on a per Shopify store basis. Due to variations in the tax rate for each country, it cannot be set up individually for each country."

Positive Grid currently only has tax ID numbers for specific countries. As a result, we can only provide VAT invoices to customers from these selected countries who wish to request a VAT refund from their local government.

To request an invoice with a VAT number, customers are required to provide both a valid VAT number and a business address.

The agent can verify the VAT number with the following site: Check the VAT number

Once the validity of the VAT number is confirmed, send the following information and tag Heyling/WeiTing on Supt-Private channel to create an invoice with VAT number:

-

Order#

-

VAT#

-

Billing Address (should be a company address)

The shipping address and information must match the original order on Shopify. The billing address can be adjusted without any issues.

訂購人姓名和shipping address必須跟原訂單相同 billing address可以調整沒關係

How to Calculate the Tax¶

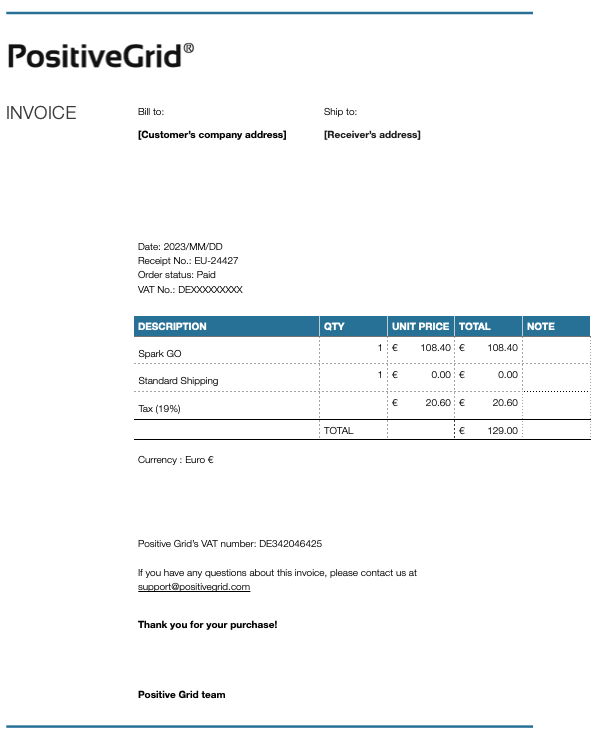

All results should be rounded to two decimal places. Please ensure that the Total on the invoice equals the order's total.

Offer a VAT Invoice with a Corresponding Tax Rate¶

Customers from Germany, the UK, and Australia with a valid VAT number and business address, who request a VAT invoice, will receive a comprehensive invoice with all necessary details from Shopify, including the corresponding VAT number.

For customers who do NOT have a valid VAT number & business address who request a VAT invoice, we can issue a VAT invoice listing the tax (based on the country).

If the order doesn't include tax & tax rate, please refer to the VAT tax rate form.

Do NOT issue a VAT refund for these cases.

Germany (DE): DE342046425 United Kingdom (UK): GB374894639 Australia (AU): 14 526 244 781

Offer a VAT Invoice with a 0% Tax Rate¶

Customers from countries in the EU (other than Germany) with a valid VAT number & business address, who request a VAT invoice, will receive an invoice with a 0% tax rate.

We'll also issue a partial refund directly as a VAT refund on Shopify later (depending on the tax being charged on Shopify).

Direct VAT Refunds¶

Positive Grid does NOT provide a tax refund unless the customer can provide a relevant documents. (20240924)

This policy is applicable to all customers with valid VAT number and business address in the EU countries except Germany (DE), we'll issue a partial refund directly as a VAT refund on Spotify later (depending on the tax being charged on Shopify).

For example, Order#EU-24504 has 20% tax, we will issue a partial refund €19.84 as tax return.

If the order doesn't include tax & tax rate, please refer to the VAT tax rate form.

Please leave the refund reason as "VAT return - VAT No.", for example, "VAT return - FR79894580356".

Refer to the Refund Process - Check Basecamp for updates for further details.

No VAT Concerns¶

For countries such as Canada (CA) Japan (JP) where we don't charge VAT during checkout, there are no related concerns.

EU: France (FR), Germany (DE), Italy (IT), Netherland (NL), Spain (ES), Czech (CZ), Poland (PL): + 22%

Australia (AU): +10%

United Kingdom (UK): +20%

Positive Grid's valid VAT#:

France (FR): FR79894580356

Germany (DE): DE342046425

Italy (IT): IT03926380043

Netherland (NL): NL826502283B01

Spain (ES): N0087358H

Czech (CZ): CZ685420308

Poland (PL): PL5263387743

Australia (AU): 14 526 244 781 ~~

~~United Kingdom (UK): GB374894639